Texas Franchise Tax No Tax Due Threshold 2025. No tax due threshold has increased to 2.47 million for reports due on or after january 1, 2025. No tax due revenue threshold.

There are three ways to file the texas franchise tax report: If this is not your first time filing a no tax due report, your.

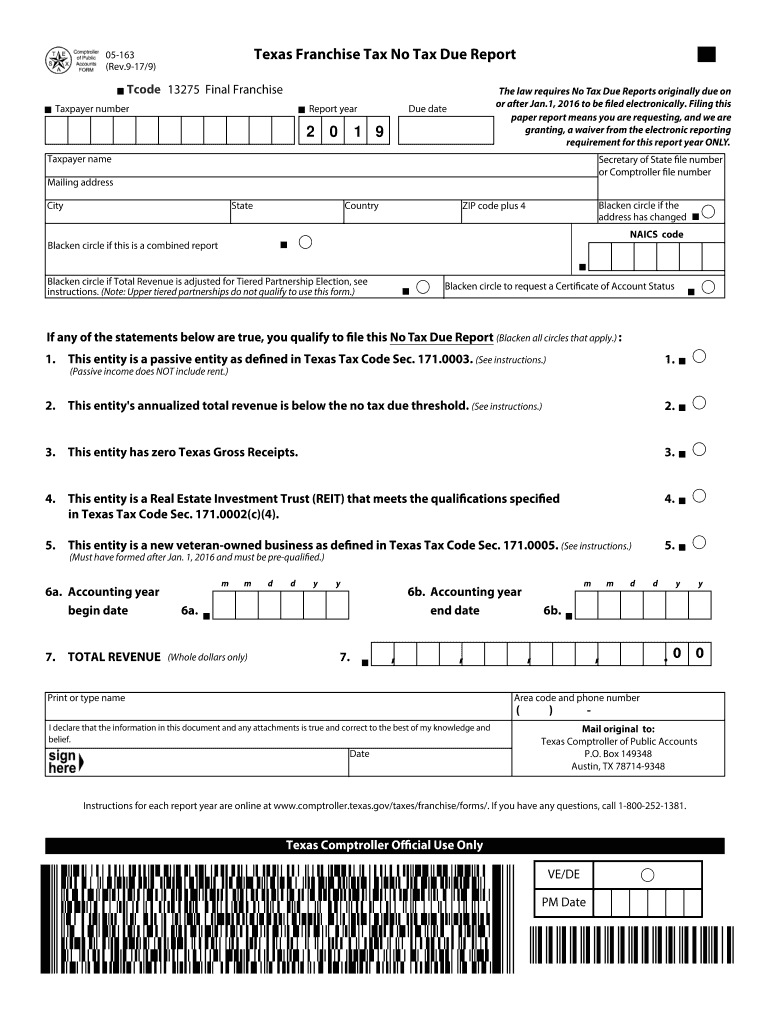

How To File Texas Franchise Tax No Tax Due Report, Your llc’s report year will be 2025. It is not due until may 15th.

Texas Franchise Tax Changes Increase in NoTaxDue Threshold and, On december 20, 2019, the texas comptroller of public accounts (comptroller) adopted amendments to its franchise margin tax nexus rule (34 tac section 3.586) (section. “no tax due” reports no longer required.

How To File Texas Franchise Tax No Tax Due Report, Effective for reports originally due on or after jan. Your llc’s report year will be 2025.

What You Need to Know about the Texas Comptroller Franchise Tax YouTube, This has often been overlooked by business owners, resulting in a $50 penalty for a report filed after the due date. I don't understand why not lacerte not have it out yet.

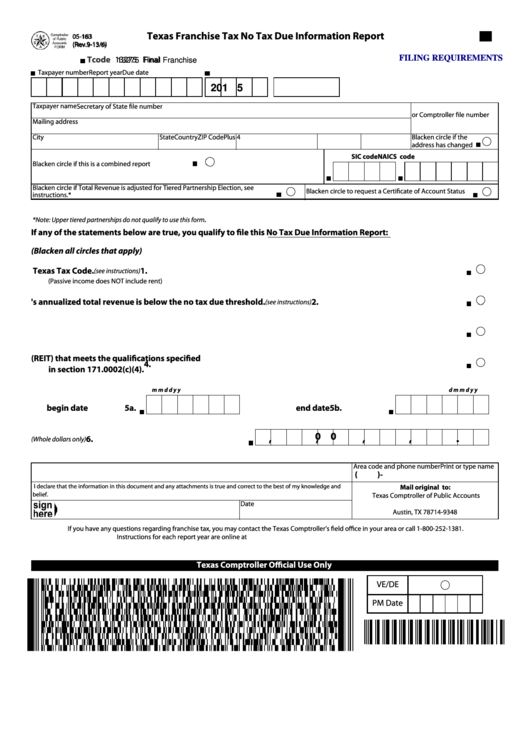

Texas franchise tax instructions 2025 Fill out & sign online DocHub, The texas comptroller is discontinuing the no tax. 2025, s3 (2nd s.s.) increases the no tax.

How To Fill Out A Texas Franchise Tax Report, The texas comptroller of public. How difficult is it to program a no tax due texas franchise tax form?

2025 Texas Franchise Tax Reporting Changes BSH Accounting, No tax due revenue threshold. How difficult is it to program a no tax due texas franchise tax form?

Texas Franchise Tax Changes to No Tax Due Reporting for 2025, 1, 2025, senate bill (sb) 3, 88th legislature, second called session, increases the no tax due threshold to $2.47 million. 2025, s3 (2nd s.s.) increases the no tax.

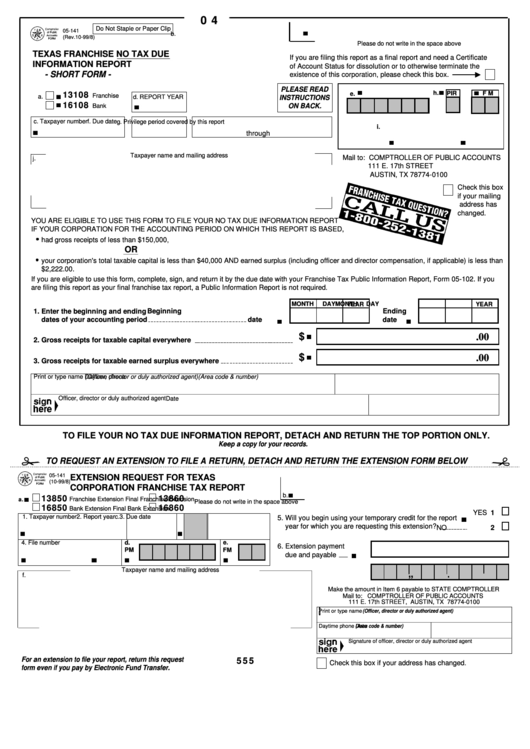

Fillable Form 05141 Texas Franchise No Tax Due Information Report, I don't understand why not lacerte not have it out yet. The texas comptroller is discontinuing the no tax.

Fillable Texas Franchise Tax No Tax Due Information Report printable, There are three ways to file the texas franchise tax report: How difficult is it to program a no tax due texas franchise tax form?

In july 2025, the texas legislature passed senate bill 3, which increased the no tax due threshold and eliminated reporting requirements for certain entities.

1, 2025, senate bill (sb) 3, 88th legislature, second called session, increases the no tax due threshold to $2.47 million.